Whether you’re a student studying in the U.S. or you are in the process of applying for a green card, a credit card in the USA for foreigners is a convenient way to afford purchases and build credit history. The good news is that it’s possible to get a credit card for non-residents.

The option that works best for you will depend on your personal financial and residence situation. Keep reading for the answers on how to get a U.S. credit card for non-residents and general insights into credit cards for foreigners.

It’s entirely possible to get a credit card as a non-U.S. citizen. It’s also legal. However, you may run into potential roadblocks along the way.

Credit card companies need to have a way to verify the identity of card users. Also, some companies only offer cards to U.S. citizens or permanent residents with a Social Security number (SSN).

While many credit card companies only offer cards to legal permanent residents or U.S. citizens, some banks and credit unions offer credit cards for non-U.S. citizens.

Most credit card companies offer credit cards to legal residents and U.S. citizens alike. Undocumented immigrants may have fewer options, but there are still credit card issuers, banks and credit unions that offer foreigner credit cards to applicants, regardless of citizenship status.

American Express, for example, will check international credit history if you don’t have U.S. credit history. This allows people from Canada, Australia, Mexico, India or the U.K. to apply for a U.S. credit card, even without a Social Security number or legal permanent residence.

Most card issuers will ask for your Social Security number. If you can’t obtain a Social Security number, you may be able to apply for an Individual Taxpayer Identification Number (ITIN) through the IRS and use that instead.

An ITIN is available to certain non-residents and resident aliens who need to file federal income tax returns in the U.S. when they don’t qualify for an SSN. An ITIN can help people who are applying for a credit card or opening a bank account as well.

Even if you cannot get an ITIN, some banks and credit unions will let you apply for a credit card without a SSN or ITIN. For example, Deserve has a credit card in the USA for foreigners, specifically for international undergraduate students. Additionally, Discover offers a credit card for foreigners, especially for international graduate students.

As a foreigner, you may not have U.S.-based credit history, but even without U.S. credit history, you have several options when it comes to applying for credit cards for non-residents. For example, American Express accepts international credit history if you don’t have U.S. credit history.

When you apply for an AMEX, you can select the option that says “I don’t have credit history in the U.S.” It can be found in the Social Security Number (SSN) field on the application page. Then, Amex will let you transfer your international credit history as part of your application.

Chase and Capital One also offer foreigner credit cards specifically designed for immigrants, students and other individuals who do not have SSNs or U.S. credit history. As an alternative, you can have a friend or family member with a good credit score and longer credit history add you to their account.

This plan can help you build U.S. credit history. From there, you can eventually be approved for your own credit card.

The application process is roughly the same for citizens as it is for non-citizens. However, if you’re missing one of the requirements, you may run into delays or be rejected altogether. For that reason, it’s a good idea to be prepared by having the following information on hand:

International credit history can help you access a U.S. credit card, but it will depend on the issuer. Nova Credit has partnered with American Express, which offers unique technology that can translate international credit data from other countries into U.S.-equivalent scores.

These countries include Australia, Canada, India, Mexico, the U.K. and various others. This can help people with good international credit to get accepted for U.S.-based cards that require a credit history or a certain credit score.

From the moment you have a U.S. credit card, you’ll start building a U.S. credit history. That includes payment history, credit mix, credit utilization and other new credit lines. All major credit card companies report to the three major credit unions, and this becomes your credit history.

If you cannot get your own credit card for non-residents, being added as an authorized user to a friend or family member’s credit card can also help build credit history in the U.S.

Whether you’re a student or an immigrant, you can access a credit card for foreigners and build U.S. credit history. For many, the first step is to ask a friend or family member to add them as a registered user so that they can start building credit history. Just make sure your family members or friends have a good credit score themselves!

Most major credit cards, including Amex, Chase and Capital One, offer credit cards for non-residents, including immigrants and students. Gather your paperwork, including passport information and proof of income. From there, you can apply for a credit card and start building your U.S. credit history right away.

Yes, it is possible for illegal immigrants to get credit cards. American Express, Chase and Capital One all offer credit cards for foreigners, which are open to illegal immigrants.

You can search online for the best current credit cards for immigrants. Credit card offers will vary, so consider reaching out to them. Credit cards for non-U.S. citizens have lower barriers of entry as well. Amex, Chase and Capital One usually have options available to immigrants.

To get a U.S. credit card, you’ll need to apply for the card directly. Several major banks offer credit cards for foreigners. It helps if you already have U.S. or international credit history. Most credit card companies will require that you have a bank account, a job and proof of income.

Written by Lindsey Ryan Lindsey is a full-time entrepreneur and part-time writer in the personal finance space. Through writing, she enjoys sharing her knowledge of business growth, family finance and building your financial profile. Her passions outside work include spending time with her family and pets, traveling as much as possible and cooking.

Disclosures

This material is for informational purposes only and should not be construed as financial, legal, or tax advice. You should consult your own financial, legal, and tax advisors before engaging in any transaction. Information, including hypothetical projections of finances, may not take into account taxes, commissions, or other factors which may significantly affect potential outcomes. This material should not be considered an offer or recommendation to buy or sell a security. While information and sources are believed to be accurate, MoneyLion does not guarantee the accuracy or completeness of any information or source provided herein and is under no obligation to update this information. For more information about MoneyLion, please visit https://www.moneylion.com/terms-and-conditions/.

MoneyLion budgeting tools are provided for informational purposes only and and should not be construed as legal, tax, investment, financial, or other advice. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on MoneyLion budgeting tools. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice.

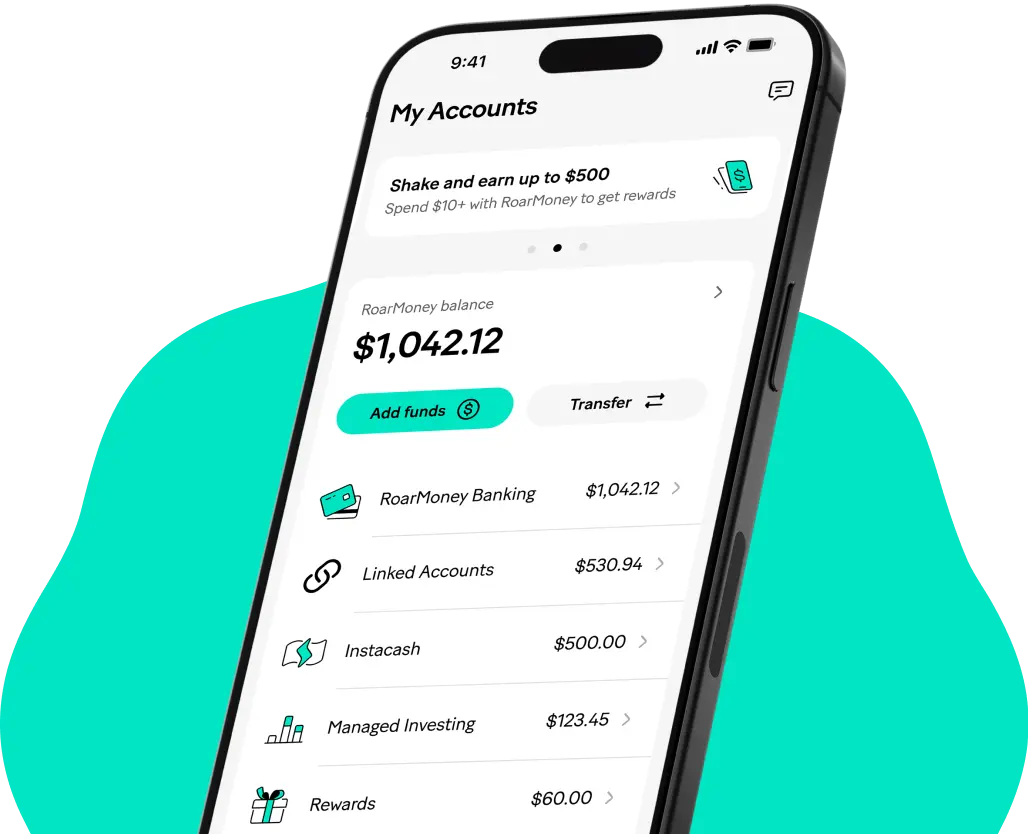

Get Instacash advances up to $500 for everyday expenses or life’s surprises. There’s no credit check, no monthly fee, and no interest.

![]()

![]()

![]()

![]()

![]()

TikTok

![]()

![]()

![]()

![]()

![]()

YouTube

MoneyLion NMLS ID 1237506

© 2013 - 2024, MoneyLion Inc. All Rights Reserved.