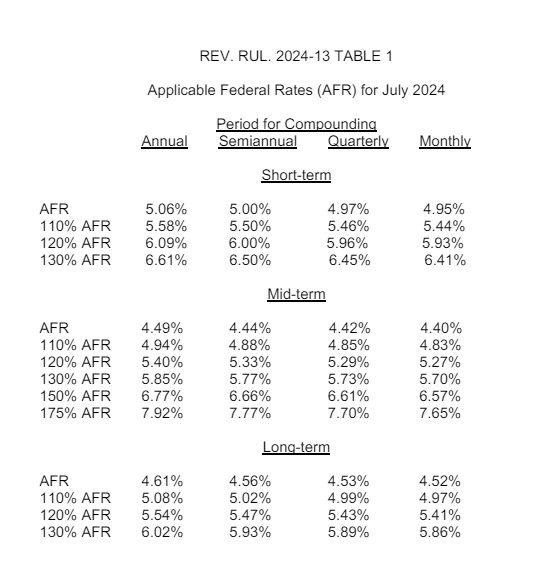

The IRS has released (Rev. Rul. 2024-13) the Applicable Federal Rates under Sec. 1274(d) of the Internal Revenue Code for July 2024. These rates are used for various tax purposes, including minimum rates for loans.

There are rates for "short-term," "mid-term," and "long-term" instruments. Short-term covers demand loans and instruments extending up to three years. Mid-term covers loans and instruments of over three years and up to nine years. Long-term covers loans and instruments with maturities longer than nine years.

The Section 382 long-term tax-exempt rate used to compute the loss carryforward limits for corporation ownership changes during July 2024 is 3.62%

The Section 7520 rate for July 2024 is 5.4%. Higher Sec. 7520 rates benefit Qualified Personal Residence Trusts (QPRTs) and Charitable Remainder Annuity Trusts (CRATs). Lower Sec. 7520 rates benefit Grantor Retained Annuity Trusts (GRATs), Charitable Lead Annuity Trusts (CLATs) and Private Annuities.

Historical AFRs are available here.

From business growth to compliance and digital optimization, Eide Bailly is here to help you thrive and embrace opportunity.

Material discussed is meant to provide general information and it is not to be construed as specific investment, tax or legal advice. Keep in mind that current and historical facts may not be indicative of future results. This is meant for educational purposes only. Information presented should not be considered investment advice or a recommendation to take a particular course of action. Always consult with a financial professional regarding your personal situation before making any financial decisions.